private reit tax advantages

2 Distributions are not guaranteed and may be. Florham Park NJ 07932.

Reit Tax Benefits Questioned As Influence Over Nursing Homes Rises

REITs function like a blocker corporation in a real estate investment fund so.

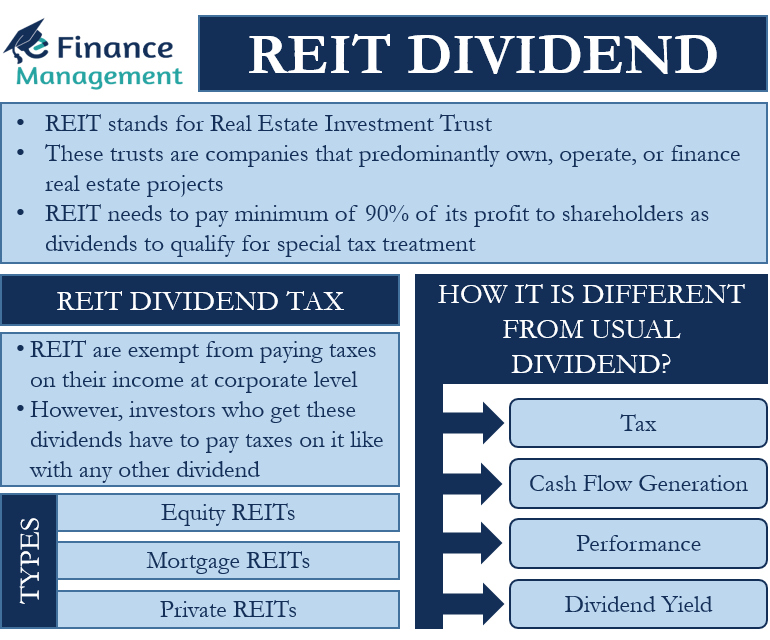

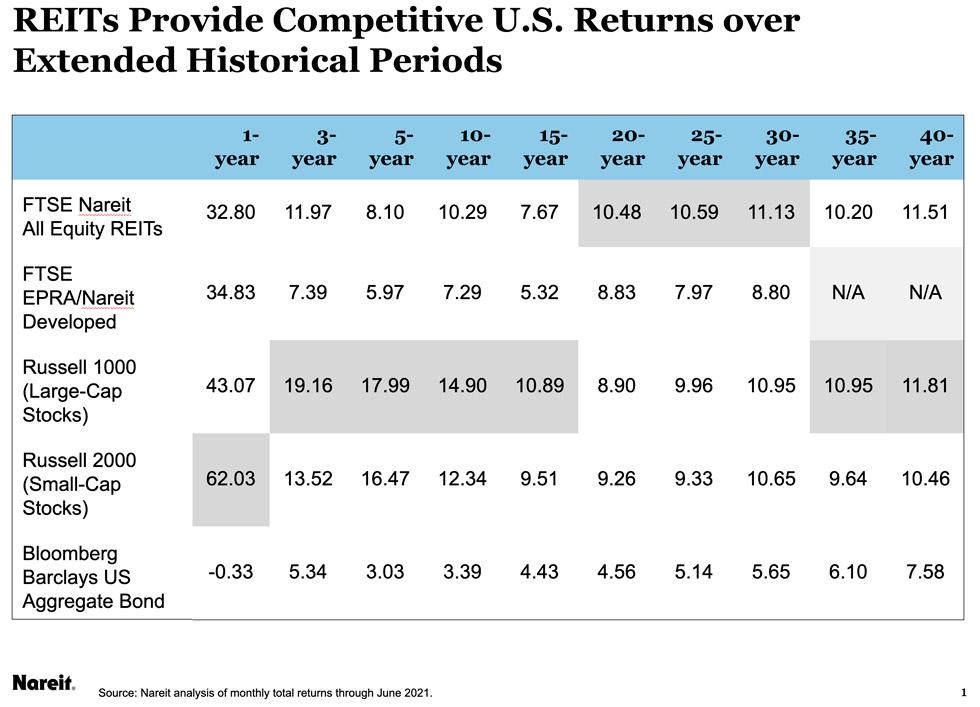

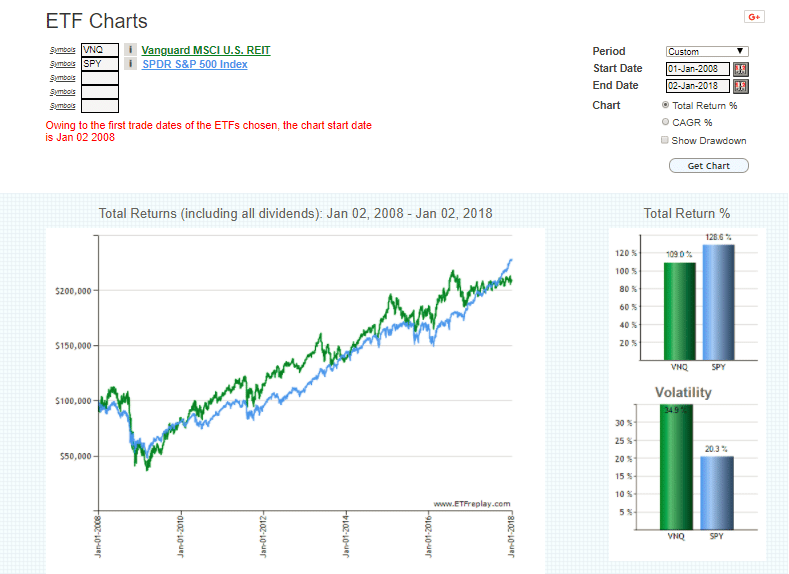

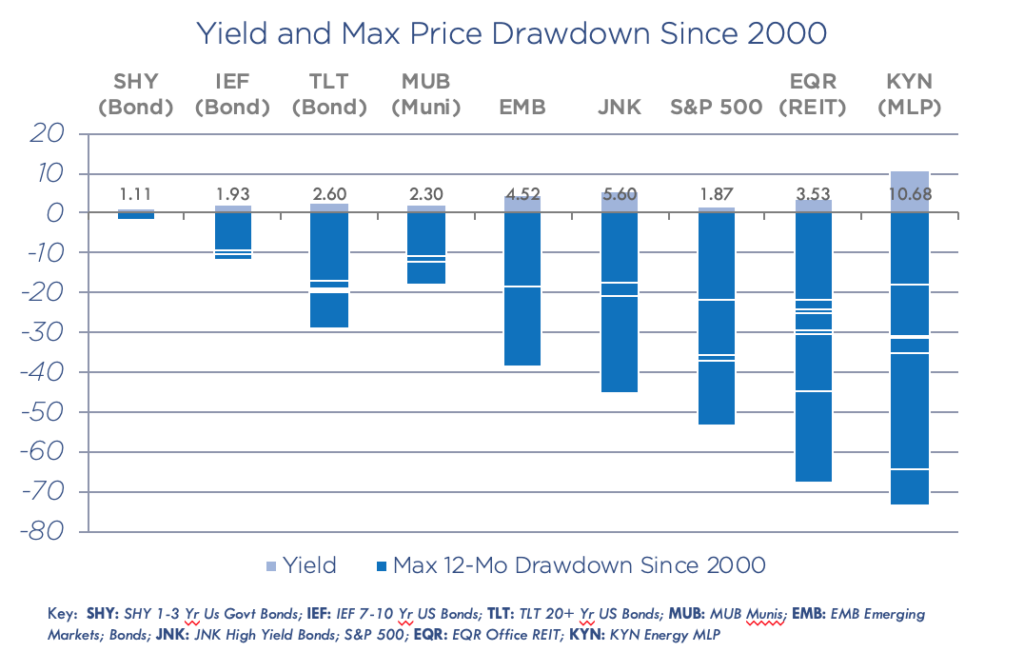

. Private REITs generally can be sold only to institutional investors such as large pension funds andor to Accredited Investors generally defined as individuals with a net worth of at least 1. Returns are a critical part of most REIT Advantages and Disadvantages. REIT investors can deduct up to 20 of ordinary dividends before income tax is.

Another advantage of REITs is that they must annually distribute almost all of their rental and capital income as dividends to shareholders which results in some. CORPORATE PROPERTY INVESTORS. For starters REITs must disburse.

Being able to reduce your. Behringer Harvard Reit I Inc in Piscataway NJ. In most cases I feel that the drawbacks of private REIT investing outweigh the potential benefits.

Wachovia Hybrid and Preferred Securities WHPPSM Indicies. Market capitalization weighted indicies designed by Wachovia to measure the performance of the US. Ive evaluated many private REITs.

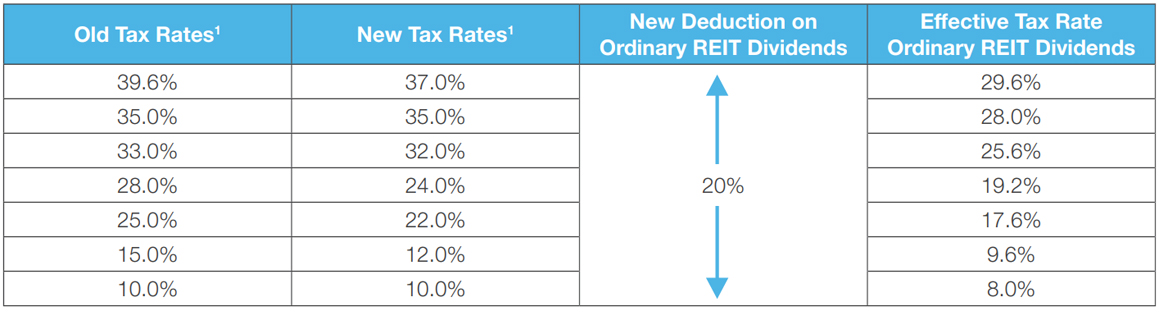

REITs are popular real estate assets for many reasons but the REIT tax advantages are a big reason. Current federal tax provisions allow for a 20 deduction on pass-through income through the end of 2025. TAX COURT OF NEW JERSEY DOCKET NO.

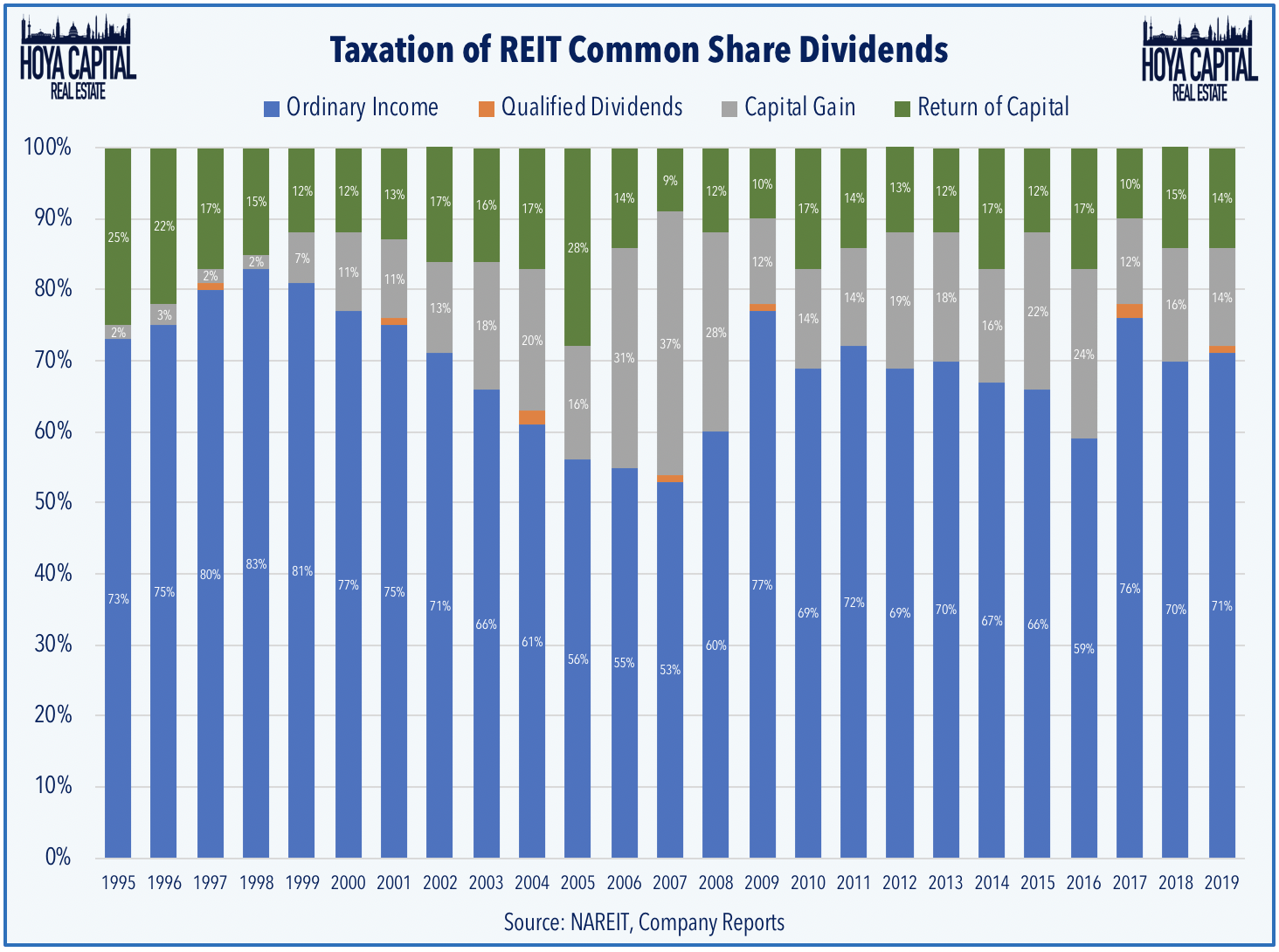

In addition REIT investors benefit from a 20 rate reduction to individual tax rates on the ordinary income portion of distributions. Tax benefits of REITs. Cornerstone Combines The Power Of 1031 Securitized Real Estate.

The list below summarizes a few of the main advantages of starting a private REIT. Individual REIT shareholders can. Earlier this month Griffin-American Healthcare REIT III also entered agreements to acquire Premier Medical Office Building a 45000-square-foot medical office building in Novi.

Reit Management Research Inc. Heres my two cents on private REITs. APPROVAL OF THE TAX COURT COMMITTEE ON OPINIONS.

Name A - Z Sponsored Links. Tax Advantages of REITs. Reit Management Research Inc.

The REIT shareholders remit tax on ordinary and capital gain dividend income at their respective tax rates. REITs are an excellent way for people to build their passive income. Educational Research 973 822-3389.

The primary tax benefit of a REIT is the avoidance of what is called double taxation that is the payment of corporate tax and personal tax on the same income. Private REITs can potentially offer target total returns ranging from 10-13 and cash yields from Most private. Principal and interest payments on any borrowings will reduce the amount of funds available for distribution or investment in additional real estate assets.

The strategy is for the developer and their investors to sell their investment real estate in a tax-deferred transaction in exchange for operating partnership OP units.

Reit Dividend All You Need To Know

Real Estate Tax Advantage Bluerock

Private Reits Maximize Qbi Deduction Dallas Business Income Tax Services

What Is A Reit Real Estate Investment Trust Reit Com

What Is A Reit Reit Tax Advantages Cpa Firms Atlanta Ga

Reit Investing What Is A Reit Ally

Real Estate Investing 101 Reits Vs Private Placements Caliber

Reit Tax Advantages Why Investors Choose Reits Arrived Homes Learning Center Start Investing In Rental Properties

The Definitive Breakdown Of Reits Vs Private Reits Aspen Funds

Reit Tax Advantages Why Investors Choose Reits Arrived Homes Learning Center Start Investing In Rental Properties

Private Equity Vs Public Equity Raising Real Estate Capital

Reit Tax Efficiency A Case Study Fundrise

The Beginner S Guide To Real Estate Crowdfunding Pros Cons And Tax Advantages Financial Freedom Countdown

The Taxman Cometh Reit Tax Myths Seeking Alpha

A Complete Guide To Reit Taxes The Ascent By Motley Fool

New Tax Act Provides Substantial Tax Savings To Reit Shareholders Inland Investments

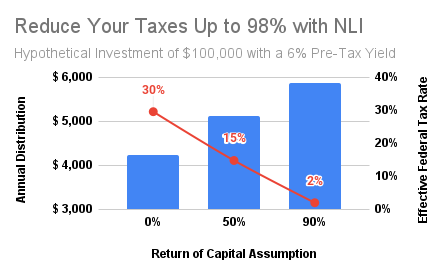

What Are The Potential Tax Benefits Of Private Real Estate Investing Noyack Logistics

/DDM_INV_REIT_final-c25e927cfd044ee79c56a6ddf1a6a696.jpg)

Real Estate Investment Trust Reit How They Work And How To Invest